The Institut des Finances Basil Fuleihan is dedicated to enhancing financial and economic literacy among the Lebanese population. It seeks to improve access to financial information, particularly concerning citizens' rights and obligations toward public tax administrations. In this context, and in collaboration with local and regional stakeholders, the Institute has developed a range of tools over the years, including booklets, guides, and interactive games, aimed at fostering economic and financial literacy among students, teachers, and overall citizens engaged in various tax procedures.

Among the tools developed by the Institute:

- Fiscal and Financial Awareness Guide: This series consists of nine guides designed to inform citizens about their rights and obligations regarding various tax procedures, including wage and salary taxation, inheritance tax, built-property tax, and more.

- Citizen Budget : The Citizen Budget tool allows both citizens and experts to familiarize themselves with the general budget law, enabling them to read and analyze expenditure and revenue figures, along with other policy decisions included in the budget that directly impact their lives. An interactive dashboard was developed in collaboration of the Budget Directorate at the Ministry of Finance, providing an overview of public revenue and spending data, while shedding the light on fiscal deficits.

- Booklets and infographics: These products aim to demystify the relationship between citizens and the state, as well as between citizens and money, while presenting key principles of public finance in an accessible manner.

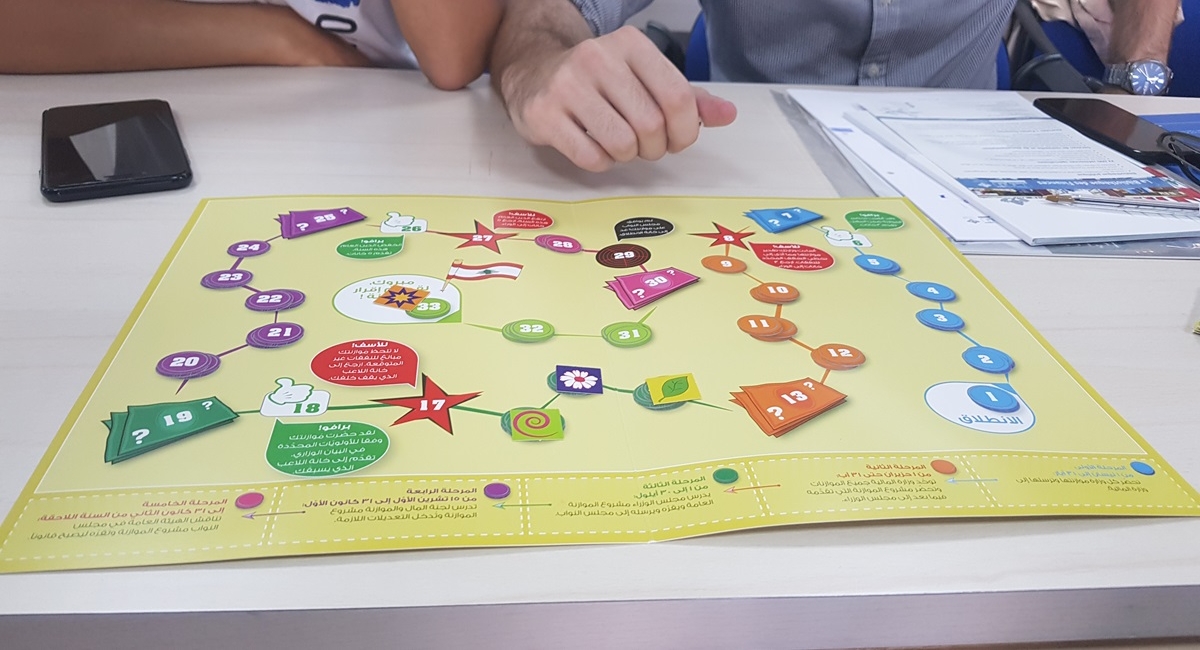

- Gamification: Educational and pedagogical games targeted to youth and economic teachers aim at enhancing economic and financial literacy of youth, but also to aid teachers in communicating the information to students.

- "Game of Flous": an interactive game based on the "Why Do We Pay Taxes?" booklet, designed to make the budget preparation process engaging and fun.

- "Big Bank Challenge": an educational game explaining banking services and products, developed in cooperation with Financially Wise (FiWi) and Fransabank.

- Micro-learning platform: this online learning tool based on the "Why Do We Pay Taxes?" booklet and aims to explain public financial concepts through an electonic platform. Check it out.

- Malouka wa ma Alayka program: click here to know more about this financial literacy program targeted to youth

To this day, over 32,000 tools, ranging from guides, reports and games have been distributed across schools, universities, youth clubs, and through conferences, meetings, and book fairs, receiving positive feedback for their interactive and engaging approach, and their effectiveness in fostering a deeper understanding of financial concepts.